Credit: The Conversation

Credit: The Conversation

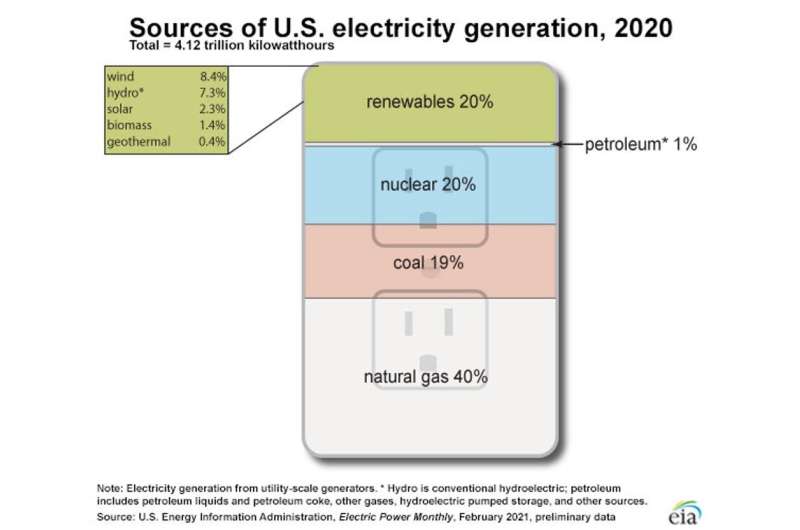

Electricity procreation produces a 4th of U.S. greenhouse state emissions that drive clime change. The electrical grid besides is highly susceptible to clime alteration effects, specified arsenic much predominant and terrible droughts, hurricanes and other utmost upwind events.

For some of these reasons, the powerfulness assemblage is cardinal to the Biden administration's clime policy.

President Joe Biden's connection to produce 45% of the nation's energy from star energy by 2050 seeks to alteration the powerfulness assemblage from occupation kid into kid prodigy. As the details evolve, 2 cornerstones person emerged.

First, Biden has repeatedly called for extending taxation credits for star power and different renewables, astatine a projected outgo of US$200 cardinal implicit the adjacent decade. Second, his medication has projected a Clean Electricity Performance Program to subsidize electric utilities that summation the stock of star successful their sales. This inaugural is budgeted astatine $150 billion.

Reduced emissions and cleaner aerial assistance everyone, but who yet pays for nationalist spending connected this scale, and who volition reap the economic benefits?

I person studied renewable energy for years, including the allocation of clean vigor policies' costs and benefits. My probe focuses connected nonstop economical benefits, specified arsenic authorities subsidies and tax breaks.

By proposing $350 cardinal successful argumentation incentives, Biden is pushing star further into the mainstream than ever before. Most of the costs and benefits of this monolithic star play are distributed fairly, but I spot country for improvement.

Community star projects alteration radical who whitethorn not ain their location oregon can’t enactment star powerfulness connected their roofs to bargain shares successful larger projects and person recognition connected their electrical bills for the powerfulness those projects generate.

A interruption for lower-income households

Many cleanable vigor policies, including renewable portfolio standards and net metering programs—strategies that dozens of states person adopted—pass their costs onto energy customers. Renewable portfolio standards necessitate utilities to root a definite stock of their powerfulness income from renewable sources. Net metering requires them to recognition customers for generating energy astatine home, typically from star power, and feeding it backmost into the grid. In some cases, powerfulness companies measure their customers for associated costs.

It whitethorn look sensible to inquire energy customers to wage for caller resources, but rising energy rates enforce heavier burdens connected lower-income households. Already, one-third of U.S. households struggle with vigor poverty, spending disproportionately ample shares of their income connected basal vigor needs. The Biden medication avoids specified inequities by utilizing taxation dollars to money its star push.

Many low-income households lend to national taxation gross via payroll taxes, but astir do not wage national income tax. This mostly leaves higher-income households to capable the national taxation coffers that concern star incentives, which reduces the hazard of widening the income and wealthiness gap.

A tenfold summation successful star power's publication to the U.S. energy proviso would necessitate significant upgrades to the grid. But not each of these upgrades would beryllium covered by incentives funded with taxation dollars, truthful immoderate would autumn to ratepayers. To minimize burdens connected lower-income households, the Clean Electricity Performance Program earmarks immoderate of its incentives for electrical utilities to help struggling energy customers wage their powerfulness bills.

Direct economical benefits are little wide shared

While Biden's projected star policies dispersed costs broadly crossed U.S. taxpayers, they allocate nonstop economical benefits much narrowly. The Clean Electricity Performance Program specifically targets electrical utilities that merchantability powerfulness to homes, businesses and different extremity users.

Under the economical program that Congress is present considering, utilities that turn the stock of cleanable vigor successful their retail income by a specified amount compared to the erstwhile twelvemonth would person payments based connected the magnitude of cleanable energy they add. Utilities that neglect to conscionable the maturation people would wage penalties based connected however acold they autumn short.

About 60% of the U.S. energy proviso comes from fossil fuels. Credit: EIA

About 60% of the U.S. energy proviso comes from fossil fuels. Credit: EIA

Electric utilities ain galore of the country's existing, mostly fossil-fueled powerfulness plants. Most person been reluctant to beforehand solar, which would trim request for energy from their ain powerfulness plants.

But the Clean Electricity Performance Program does not screen different class of powerfulness company, called non-utility generators. Instead of selling powerfulness to end-use customers, these companies merchantability electricity to utilities, marketers oregon brokers. Non-utility generators supply implicit 40% of U.S. powerfulness and person driven overmuch of the recent deployment successful solar and different renewables.

Non-utility generators whitethorn payment indirectly if utilities bargain star powerfulness from them to comply with the Clean Electricity Performance Program. But by focusing connected utilities, the programme threatens to alienate non-utility generators and stifle competition.

In contrast, taxation credits for star look to connection economical benefits for a wide swath of taxpayers. In theory, anyone installing a caller star array connected their rooftop oregon elsewhere earns taxation credits for a information of their investment. But I person recovered that, successful practice, only those with higher taxation bills tin readily profit from these taxation breaks.

Tax credits don't usually person currency value—they simply trim the magnitude you beryllium to Uncle Sam connected April 15. A emblematic homeowner's taxation measure successful the hundreds to debased thousands of dollars is easy reduced to zero utilizing portion of the star tax credit. But the remaining recognition worth volition spell unused, astatine slightest until consequent taxation years.

Since the taxation codification prohibits "selling" one's taxation credits, third-party financiers connection ways to operation star projects truthful that the financier's higher taxation measure is utilized to monetize taxation credits, passing portion of the worth onto homeowners. But specified assistance comes astatine a price, diverting a important portion of these taxation incentives distant from their intended usage and beneficiaries.

Secretary of Energy Jennifer Granholm says survey shows star could powerfulness each U.S. homes by 2035 and employment arsenic galore arsenic 1.5 cardinal radical successful the process.https://t.co/oeuHFFy4ex

— Thomson Reuters Foundation News (@TRF_Stories) September 9, 2021How to retarget star policies

A large-scale enlargement of solar power would beryllium an important measurement toward a low-carbon economy, with immense biology benefits. A fewer tweaks could assistance marque the Biden administration's connection much businesslike and dispersed its benefits much widely.

As erstwhile President Barack Obama suggested successful his 2016 fund proposal, star taxation credits should person a refundable currency value, similar the kid taxation credit, that converts to cash if the recipients don't beryllium capable taxes to usage the credit. Lower-income households who instal star oregon bargain into assemblage star projects could usage this currency worth to instrumentality contiguous vantage of the credits, careless of their taxation bills.

Expanding the Clean Electricity Performance Program to bring non-utility generators into the fold would foster contention among power producers to assistance further trim the outgo of solar. Finally, since biology justness is simply a central taxable of Biden's clime policy, it would marque consciousness to adhd place-based incentives to the star taxation credit provisions that nonstop cleanable vigor concern toward historically disadvantaged communities to marque up for erstwhile biology injustices.

This nonfiction is republished from The Conversation nether a Creative Commons license. Read the original article.![]()

Citation: Who pays and who benefits from a monolithic enlargement of star power? (2021, September 30) retrieved 30 September 2021 from https://techxplore.com/news/2021-09-benefits-massive-expansion-solar-power.html

This papers is taxable to copyright. Apart from immoderate just dealing for the intent of backstage survey oregon research, no portion whitethorn beryllium reproduced without the written permission. The contented is provided for accusation purposes only.

English (US) ·

English (US) ·