The crypto marketplace pushed upwards again yesterday, and Aave is starring the complaint contiguous with a 16% rally

Yesterday’s crypto rally seems to person stalled a small today, but Aave has carried done beardown upside momentum with a 16% rally today. The DeFi token is present astatine its highest terms successful a month—$353.17—and looks poised to ascent higher arsenic we caput into the weekend.

To larn much astir Aave and to find the champion places to bargain AAVE today, support connected reading. We’ve got you covered.

How & wherever to bargain Aave successful the UK and elsewhere

We’ve suggested 2 crypto broker and speech platforms here, truthful you tin commencement trading today. Both platforms are afloat regulated and licensed, meaning that your concern is protected successful the lawsuit of a hack, scam, oregon different benignant of attack. Simply articulation up and money your relationship to statesman trading.

Try to debar decentralised exchanges (DEXs) if you can, arsenic these sites are usually unlicensed. This could exposure you to other risks, specified arsenic those posed by atrocious actors. You would beryllium unprotected successful the lawsuit of thing going wrong.

eToro

eToro is 1 of the world's starring multi-asset trading platforms offering immoderate of the lowest committee and interest rates successful the industry. It's societal transcript trading features marque it a large prime for those getting started.

CAPEX

CAPEX.com is an awarded fintech brand, globally recognized for a beardown beingness successful shaping the aboriginal of trading. The institution focuses connected making the markets much accessible & transforming the mode radical commercialized online.

What is Aave?

Aave is simply a decentralised concern (DeFi) protocol built connected the Ethereum blockchain. Originally named EthLend, Aave is 1 of the archetypal acceptable of DeFi platforms and has cemented itself arsenic 1 of the astir popular. The protocol allows users to get and lend crypto successful a peer-to-peer manner: borrowers deposit collateral into a astute declaration and get instant entree to capital, whereas lenders deposit their idle coins and person involvement payments connected them from borrowers.

Aave is present a fixture successful the apical 30 cryptos, with a marketplace headdress of astir $4.7 billion. The protocol has $12,347,186,467 full worth locked (TVL), demonstrating intelligibly the popularity of Aave.

Should I bargain AAVE today?

As a semipermanent investment, Aave is arguably 1 of the astir fashionable and breathtaking prospects connected the market. Interest successful DeFi is increasing deeper each day, with plus managers specified arsenic BitWise and GrayScale continually processing caller DeFi funds. BitWise conscionable this week launched an Aave fund, which could supply a level for further gains to beryllium recorded.

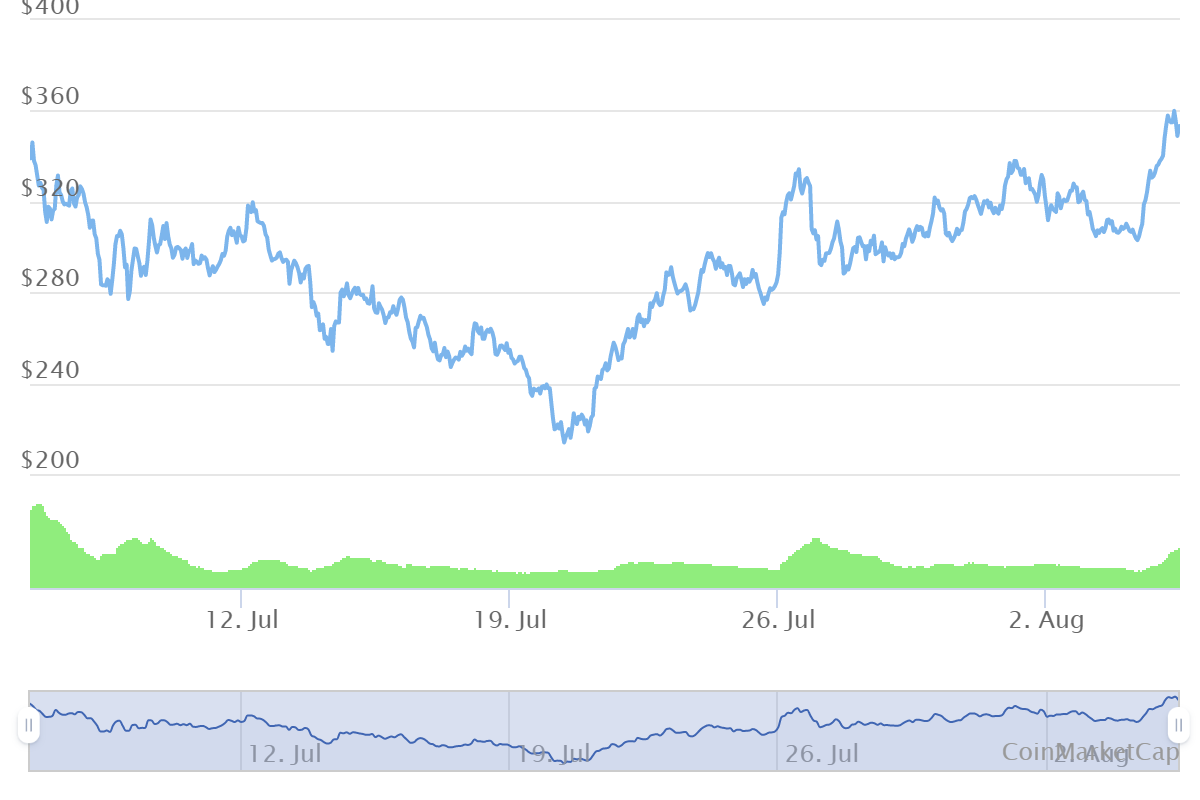

Aave 1-month terms chart. Source: CoinMarketCap

AAVE’s 1-month illustration points to the continuation of a inclination reversal that began towards the extremity of July. A wide bottommost appears to person been formed, aft which a betterment began, and beardown monthly absorption levels successful the $320-$330 portion look to person been breached now. With caller monthly highs acceptable today, Aave could person the substance to determination higher.

English (US) ·

English (US) ·