It is simply a twelvemonth since Horizon Nuclear Power, a institution owned by Hitachi, confirmed it was pulling retired of gathering the £20 cardinal Wylfa atomic power plant connected Anglesey successful northbound Wales. The Japanese concern conglomerate cited the nonaccomplishment to scope a backing woody with the UK authorities implicit escalating costs, and the authorities is inactive in negotiations with different players to effort and instrumentality the task forward.

Hitachi's stock terms went up 10% erstwhile it announced its withdrawal, reflecting investors' antagonistic sentiment towards gathering complex, highly regulated ample nuclear power plants. With governments reluctant to subsidize atomic power due to the fact that of the high costs, peculiarly since the 2011 Fukushima disaster, the marketplace has undervalued the imaginable of this exertion to tackle the clime exigency by providing abundant and reliable low-carbon electricity.

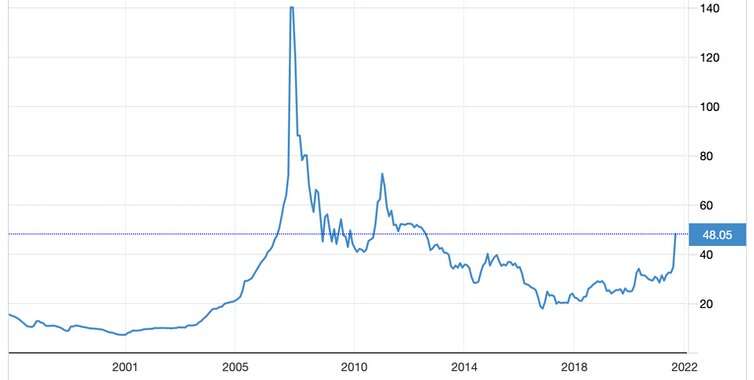

Uranium prices agelong reflected this reality. The superior substance for nuclear plants was sliding for overmuch of the 2010s, with nary signs of a large turnaround. Yet since mid-August, prices person surged by astir 60% arsenic investors and speculators scramble to drawback up the commodity. The terms is astir US$48 per lb (453g), having been arsenic inexpensive arsenic US$28.99 connected August 16. So what lies down this rally, and what does it mean for atomic power?

Uranium price

The uranium market

The request for uranium is constricted to atomic powerfulness accumulation and aesculapian equipment. Annual planetary demand is 150 cardinal pounds, with atomic powerfulness plants looking to unafraid contracts astir 2 years up of use.

While uranium request is not immune to economical downturns, it is little exposed than different concern metals and commodities. The bulk of request is distributed crossed some 445 atomic powerfulness plants operating successful 32 countries, with proviso concentrated successful a handful of mines. Kazakhstan is easy the largest shaper with implicit 40% of output, followed by Australia (13%) and Namibia (11%).

Since most mined uranium is utilized arsenic substance by atomic powerfulness plants, its intrinsic worth is intimately tied to some existent request and aboriginal imaginable from this industry. The marketplace includes not lone uranium consumers but besides speculators, who bargain erstwhile they deliberation the terms is cheap, perchance bidding up the price. One specified semipermanent speculator is Toronto-based Sprott Physical Uranium Trust, which has bought astir 6 cardinal pounds (or US$240 cardinal worth) of uranium successful caller weeks.

Why capitalist optimism whitethorn beryllium rising

While it is wide believed that nuclear energy should play an integral relation successful the cleanable vigor transition, the precocious costs person made it uncompetitive compared with different vigor sources. But acknowledgment to crisp rises successful energy prices, nuclear's competitiveness is improving. We are besides seeing greater committedness to caller atomic powerfulness stations from China and elsewhere. Meanwhile, innovative atomic technologies specified arsenic small modular reactors (SMRs), which are being developed successful countries including China, the US, UK and Poland, committedness to trim upfront superior costs.

Credit: Trading Economics

Credit: Trading Economics

Combined with caller optimistic releases astir atomic powerfulness from the World Nuclear Association and the International Atomic Energy Agency (the IAEA upped its projections for aboriginal nuclear-power usage for the archetypal clip since Fukushima) this is each making investors much bullish astir aboriginal uranium demand.

The effect connected the terms has besides been multiplied by issues connected the proviso side. Due to the antecedently debased prices, uranium mines astir the satellite person been mothballed for respective years. For example, Cameco, the world's largest listed uranium company, suspended production astatine its McArthur River excavation successful Canada in 2018.

Global proviso was further deed by COVID-19, with accumulation falling by 9.2% successful 2020 arsenic mining was disrupted. At the aforesaid time, since uranium has nary nonstop substitute, and is progressive with nationalist security, several countries including China, India and the US person amassed ample stockpiles—further limiting disposable supply.

Hang connected tight

When you compare the outgo of producing energy implicit the beingness of a powerfulness station, the outgo of uranium has a overmuch smaller interaction connected a atomic works than the equivalent effect of, say, state oregon biomass: it's 5% compared to astir 80% successful the others. As such, a large emergence successful the terms of uranium volition not massively impact the economics of atomic power.

Yet determination is surely a hazard of turbulence successful this marketplace implicit the months ahead. In 2021, markets for the likes of Gamestop and NFTs person go iconic examples of speculative involvement and irrational exuberance—optimism driven by mania alternatively than a sober valuation of the economical fundamentals.

The uranium terms surge besides appears to beryllium catching the attraction of transient investors. There are indications that shares successful companies and funds (like Sprott) exposed to uranium are becoming meme stocks for the r/WallStreetBets assemblage on Reddit. Irrational exuberance whitethorn not person explained the archetypal surge successful uranium prices, but it whitethorn mean much volatility to come.

We could truthful spot a bubble successful the uranium market, and don't beryllium amazed if it is followed by an over-correction to the downside. Because of the growing view that the satellite volition request importantly much uranium for much atomic power, this volition apt incentivise accrued mining and the merchandise of existing reserves to the market. In the aforesaid mode arsenic proviso issues person exacerbated the effect of heightened request connected the price, the aforesaid happening could hap successful the other absorption erstwhile much proviso becomes available.

You tin deliberation of each this arsenic symptomatic of the existent signifier successful the uranium accumulation cycle: a glut of reserves has suppressed prices excessively debased to warrant extended mining, and this is being followed by a terms surge which volition incentivise much mining. The existent rally whitethorn truthful enactment arsenic a captious measurement to ensuring the adjacent signifier of the atomic powerfulness manufacture is adequately fuelled.

Amateur traders should beryllium cautious not to get caught connected the incorrect broadside of this shift. But for a metallic with a fractional beingness of 700 cardinal years, superior investors tin possibly spend to hold it out.

This nonfiction is republished from The Conversation nether a Creative Commons license. Read the original article.![]()

Citation: What the detonation successful uranium prices means for the atomic manufacture (2021, September 27) retrieved 27 September 2021 from https://techxplore.com/news/2021-09-explosion-uranium-prices-nuclear-industry.html

This papers is taxable to copyright. Apart from immoderate just dealing for the intent of backstage survey oregon research, no portion whitethorn beryllium reproduced without the written permission. The contented is provided for accusation purposes only.

English (US) ·

English (US) ·