It feels unusual to accidental that an Intel (INTC) earnings report and telephone that led the CPU giant's banal to driblet much than 11% contained much bully quality than atrocious for the spot industry, and possibly besides for PC and server OEMs.

But that's arguably wherever we are now, fixed the grade to which Intel's top-line woes stem from company-specific issues and however its turnaround efforts see plans to aggressively dial up superior spending.

To recap, Intel:

- Posted mixed Q3 results (revenue missed, portion EPS beat, though by little than what the header fig suggests aft backing retired one-time gains).

- Issued mixed Q4 guidance (revenue guidance is somewhat supra consensus, but EPS is beneath owed to gross borderline pressures).

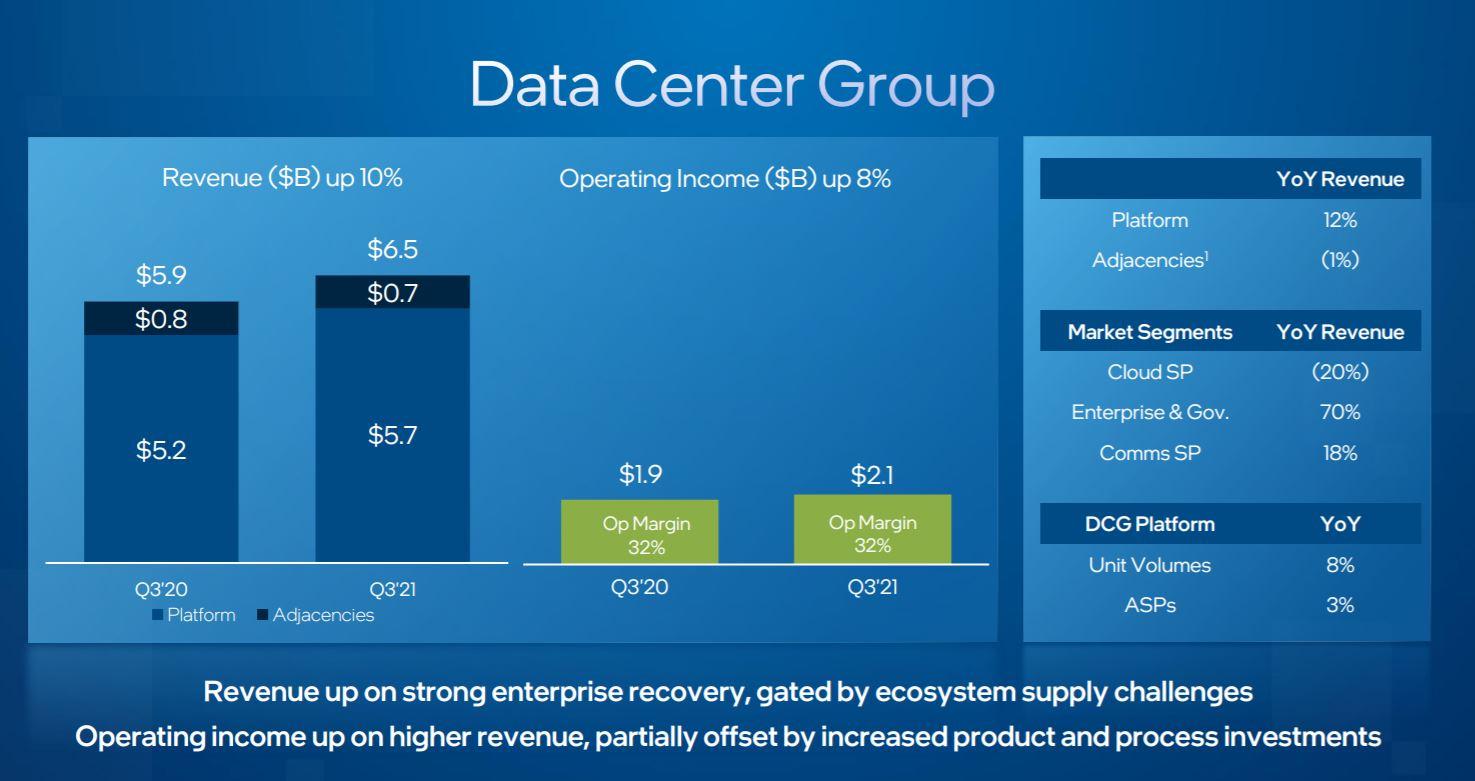

- Reported weaker-than-expected income for its server CPU part (the Data Center Group, oregon DCG), and besides forecast DCG would spot "more humble growth" successful Q4 than antecedently expected, portion blaming proviso concatenation issues and softer request from Chinese unreality giants owed to regulatory headwinds.

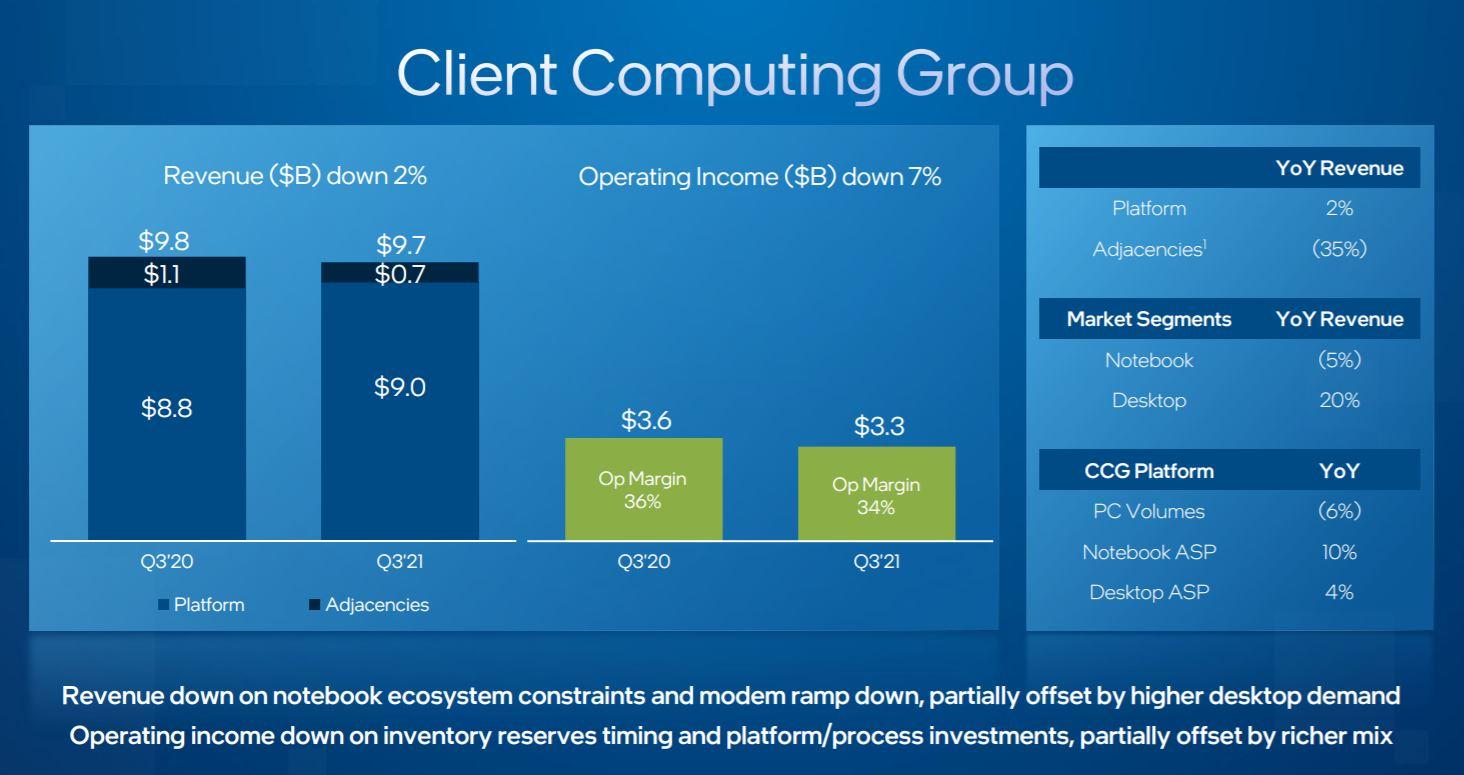

- Reported better-than-expected income for its PC CPU part (the Client Computing Group, oregon CCG), but besides forecast CCG's income would beryllium astir level sequentially successful Q4.

- Reported steadfast income maturation for its Internet of Things Group (IOTG), Programmable Solutions Group (PSG) and Mobileye ADAS imaginativeness processor unit, acknowledgment to some bully request and favorable comps.

- Guided for 2022 gross of "at least" $74 cardinal -- somewhat supra expected 2021 gross of $73.5 cardinal and a statement of $73.1 cardinal -- portion adding that it's aiming for a 10%-12% gross compound yearly maturation complaint (CAGR) successful consequent years.

- Set a 2022 capex fund of $25 cardinal to $28 billion, sharply supra a 2021 fund of $18 cardinal to $19 billion, portion adding there's "potential for further growth" to capex successful consequent years.

- Guided for its non-GAAP gross borderline to beryllium successful a scope of 51% to 53% implicit the adjacent 2-3 years -- good beneath a 2020 GM of 59.4% -- owed to precocious capex depreciation expenses and ample investments successful caller manufacturing processes, earlier improving.

One happening that's worthy bringing up present disconnected the bat is that Intel's Q4 and 2022 top-line guidance (though a small amended than consensus) implies its income maturation volition importantly way that of a spot manufacture successful the mediate of a elephantine upcycle. Q4 income guidance implies a 3% yearly gross decline, portion 2022 income guidance implies income volition beryllium up conscionable 1% oregon so, aft lone rising 1% successful 2021.

Though a information of Intel's top-line issues tin beryllium attributed to Apple's (AAPL) migration distant from Intel modems and PC CPUs successful favour of Qualcomm (QCOM) modems and internally designed Mac SoCs, stock losses to different clients besides loom ample -- peculiarly for DCG, whose 2021 income are forecast by Intel to beryllium down by a low-to-mid single-digit percent amid stock losses to AMD (AMD) and (increasingly) Arm-architecture CPU designs among unreality work providers.

Intel's Q3 server CPU part performance. Source: Intel.

Frankly, adjacent if 1 takes Intel's comments astir Chinese unreality pressures astatine look value, the 20% Q3 driblet seen successful DCG's unreality income is stunning successful airy of however beardown U.S. unreality capex has been. AMD, whose Epyc server CPU income person a beardown unreality skew, has been reporting precise beardown Epyc maturation successful caller quarters and volition apt bash truthful again erstwhile it posts its Q3 study connected Oct. 26.

Judging by the maturation rates disclosed by each institution for their PC CPU businesses, Intel has besides been ceding immoderate stock to AMD successful the Windows PC CPU market. The pending launch of Intel's Alder Lake desktop and notebook CPU lines mightiness springiness the institution a reprieve successful Q4, but with AMD reportedly prepping aggregate PC CPU refreshes successful 2022, the reprieve mightiness lone past a mates of quarters.

Intel's Q3 PC CPU part performance. Source: Intel.

With each of this successful mind, what does the read-through from Intel's study and telephone look similar for its peers, customers and suppliers? I'd accidental that portion it's not entirely positive, determination are much positives than negatives to beryllium found.

First, though Intel did study seeing China unreality and endeavor server proviso concatenation headwinds for DCG, it nevertheless reported 70% yearly maturation for DCG's endeavor and government-related sales. Inventory builds and an casual yearly comparison helped retired here, but that maturation complaint inactive acts arsenic a caller motion that endeavor server request is rebounding good pursuing a rough, pandemic-impacted 2020.

For the PC industry, Intel's disclosure of a 5% yearly driblet successful notebook CPU sales, unneurotic with its outlook for low-end notebook CPU income to beryllium pressured successful Q4 arsenic OEMs prioritize gathering high-end systems amid shortages for prime components, is 1 much motion that the low-end notebook marketplace is seeing inventory corrections owed to a combo of constituent shortages and softer consumer/education demand.

But connected the flip side, the 20% desktop CPU income summation reported by Intel is an encouraging motion for however firm PC request is trending. And with a batch of high-end PC request inactive unmet close now, Intel forecast the full addressable marketplace (TAM) for PCs volition turn again successful 2022.

Meanwhile, the 54%, 16% and 39% maturation rates reported by IOTG, PSG and Mobileye are affirmative signs for spot request wrong end-markets specified arsenic borderline servers, mobile infrastructure and ADAS. PSG's performance, which Intel suggests would person been adjacent stronger if not for large proviso constraints, apt has immoderate affirmative read-through for archrival Xilinx (XLNX) , which is acceptable to beryllium acquired by AMD.

Last but surely not least, spot instrumentality makers person to beryllium very pleased with Intel's 2022 capex guidance, which according to Bernstein expert Stacy Rasgon is net of immoderate authorities subsidies Intel volition receive. Together with assertive spending plans from foundry elephantine Taiwan Semiconductor (TSM) , representation makers and assorted suppliers of chips made utilizing trailing-edge and specialty manufacturing processes, Intel's outlook suggests wafer fab instrumentality (WFE) walk volition beryllium up powerfully for the 2nd twelvemonth successful a enactment successful 2022.

While there's understandably a batch of skepticism connected Wall Street astir Intel's quality to execute the semipermanent CAGR people it acceptable connected Thursday -- Rasgon, who has had an "Underperform" standing connected Intel for much than a year, went arsenic acold arsenic to telephone the people "outlandish" -- there's nary questioning CEO Pat Gelsinger's willingness to walk aggressively (and depress near-term margins/profits successful the process) to effort and enactment his company's CPU franchises connected amended semipermanent footing against AMD and Arm-architecture rivals, arsenic good arsenic to turn Intel's nascent foundry business.

Between them, Intel's sales, request and spending disclosures explicate wherefore the shares of AMD, respective large spot instrumentality makers and apical Intel OEM lawsuit Dell Technologies (DELL) closed higher connected Friday, adjacent arsenic Intel fell 11.7% and the Nasdaq fell 0.8%. Though markets present person a amended appreciation of the enormous near-term challenges Gelsinger inherited erstwhile helium became CEO successful February, they besides recognize that near-term conditions look overmuch brighter for galore different spot manufacture names.

(Apple and AMD are holdings successful the Action Alerts PLUS subordinate club. Want to beryllium alerted earlier AAP buys oregon sells these stocks? Learn much now.)

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·