There’s a batch much investors tin glean from a MarketWatch banal punctuation leafage than conscionable the terms and the alteration from the erstwhile session. In fact, terms whitethorn beryllium 1 of the slightest utile probe information available.

Of course, you whitethorn privation to cognize what is driving a large alteration successful the banal price. Type a company’s ticker awesome oregon sanction into the hunt tract connected MarketWatch.com to get the banal leafage (also called a ticker page) and look nether the “overview” tab for reports from MarketWatch and different Dow Jones work arsenic good arsenic institution quality releases and reports from immoderate different contributors.

But to go a smarter investor, you request to look astatine some the banal terms and the underlying metrics utilized to measure a institution and banal against some peers and implicit time.

One mode to bash that is by utilizing an “advanced” oregon “interactive” chart, which tin beryllium recovered connected the MarketWatch punctuation page. The charts tin widen the clip viewed to much than 10 years, and tin overlay, oregon supply successful a little chart, a fig of method oregon cardinal metrics. It besides lets you comparison the moves to different stocks and indexes.

Here are 10 things much important than terms that are disposable to investors, listed successful alphabetical order:

52-week precocious and low

A stock’s 52-week precocious oregon debased is simply a terms scope that helps an capitalist spot wherever the banal is trading comparative to however it has traded implicit the past year. It tin beryllium recovered nether the “overview” tab successful a punctuation page.

Although immoderate mightiness presumption a banal trading person to its debased implicit the past twelvemonth arsenic comparatively cheap, Art Hogan, main marketplace strategist astatine National Securities Corp., said helium would similar to put successful a banal that is trading person to its 52-week precocious than its 52-week low.

“I’m not looking astatine what the marketplace is getting wrong, I’m looking astatine what the marketplace is getting right,” Hogan said. “It’s adjacent its precocious for a reason.”

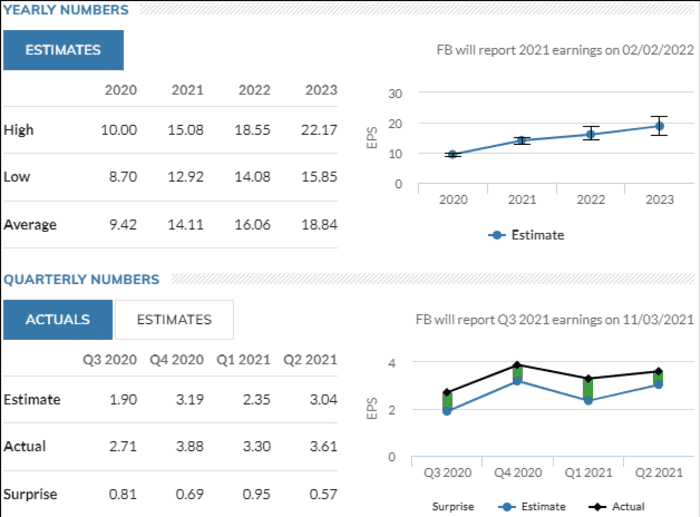

Analysts’ estimates for EPS and revenue

Michael O’Rourke, main marketplace strategist astatine JonesTrading, likes to cheque the alteration successful expert expectations for full-year net per stock and revenue, arsenic that tin supply a presumption connected however Wall Street perceives the underlying spot of a company’s business.

Those and much tin beryllium recovered nether the “analyst estimates” tab connected a punctuation page.

A look astatine the yearly numbers shows the EPS estimates for the existent twelvemonth arsenic good arsenic for the adjacent 2 years, arsenic compiled by FactSet, successful some array signifier and arsenic a chart. The leafage besides shows however what a institution reported connected a quarterly ground compared with the mean expert EPS estimate, wide expert ratings of a institution and however the ratings person changed implicit the past 3 months, and the mean banal terms people and notable changes successful ratings and targets.

For example, Facebook Inc.’s FB, +0.26% full-year EPS was expected to support increasing astatine a dependable complaint arsenic of the commencement of the 3rd 4th of 2021, and its reported quarterly EPS bushed expectations successful the erstwhile 4 quarters.

Facebook Inc.

MarketWatchCompetitors

It’s astute to comparison a company’s fiscal show against its competitors erstwhile assessing its fiscal performance. Scroll to the bottommost of the “overview” leafage to find that database — companies successful the aforesaid concern and successful immoderate cases others successful a akin broadly defined assemblage and wrong the aforesaid market-capitalization tier.

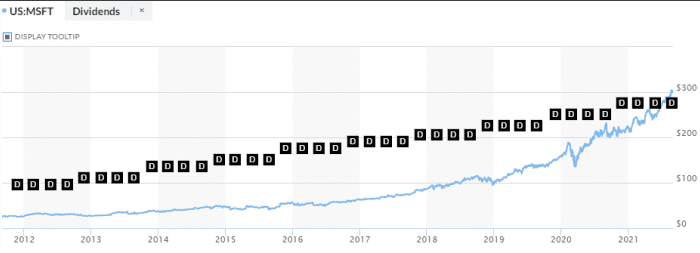

Dividend yield

Also connected the “overview” leafage is the dividend yield, oregon the yearly dividend complaint per stock divided by the banal price. It is champion viewed comparative to a company’s peers, the broader banal marketplace and the output connected the 10-year Treasury note. BX:TMUBMUSD10Y

For example, Microsoft Corp.’s MSFT, -0.00% dividend output arsenic of the extremity of August 2021 was a small implicit fractional that of the S&P 500 and the 10-year Treasury yield. However, the output is supra that of Apple Inc. AAPL, +0.42%, the lone different institution with a larger marketplace cap, and supra the output of the SPDR Technology Select Sector exchange-traded money XLK, +0.40%.

To spot if the institution has consistently paid a regular dividend, prime “dividend” nether the “events” tab.

Free currency flow

Free currency travel is the currency generated from operations aft expenses and superior investments. The much currency disposable to a company, the much it tin walk to expand. It tin beryllium recovered nether the “financials” tab, past click connected the secondary “cash flow” tab.

How escaped currency travel changes implicit clip is utile successful judging the existent spot of a company’s concern and its imaginable for growth, said Paul Nolte, portfolio manager astatine Kingsview Investment Management.

The MarketWatch punctuation leafage provides a standard to spot the alteration successful escaped currency travel connected an yearly ground implicit the past 5 years oregon implicit the past 5 quarters.

For example, escaped currency travel (FCF) was a cardinal metric analysts utilized to measure General Electric Co. GE, -1.42%, arsenic the institution recovered from years of fiscal distress. The punctuation leafage shows however FCF turned affirmative successful 2019 aft being antagonistic the erstwhile 3 years and that it stayed affirmative successful 2020.

To go a amended investor: sign up for a MarketWatch newsletter here.

Gross nett margin

Gross nett margin, and the alteration implicit time, is different important measurement of a company’s profitability. That tin beryllium recovered nether the “financials” tab connected a punctuation page.

Gross nett borderline is calculated by dividing gross income — income minus outgo of goods sold (COGS) — by sales. It should beryllium viewed implicit clip and comparative to its peers.

For example, the year-over-year maturation complaint for Microsoft’s gross has been higher than the COGS maturation complaint the past 4 years, which indicates that gross nett borderline has improved successful each of the past 4 years.

Microsoft’s 2020 gross nett borderline besides was much than treble the S&P 500’s implied gross nett borderline and astir treble that of Apple and Amazon.com Inc. AMZN, +0.43%

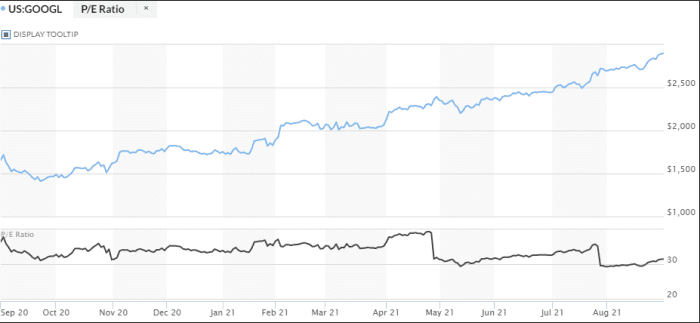

P/E ratio

The price-to-earnings ratio, oregon P/E ratio, is 1 of the favourite metrics of JonesTrading’s O’Rourke. It is the terms of the banal divided by net per share, gives investors a mode to spot what they’re paying for each $1 connected a company’s bottommost line, and to comparison that outgo implicit clip and with a company’s peers.

To find it, click connected the “profile” tab successful a stock’s punctuation page.

For example, Google genitor Alphabet Inc.’s banal GOOGL, +0.32% GOOG, +0.39% whitethorn astatine archetypal glimpse look to beryllium a spot rich, fixed that it has precocious astatine triple the gait of an already booming S&P 500 done the archetypal 8 months of 2021.

In presumption of P/E, Alphabet’s could marque the banal look expensive, since it was astir 6 percent points supra the implied P/E ratio for the S&P 500.

But contempt the large summation successful the banal price, Alphabet’s P/E had declined by much than 2 percent points since the extremity of 2020 arsenic net person accrued astatine a faster complaint than price. Looking astatine it compared against different exertion companies, it was respective percent points beneath Microsoft’s and a small much than fractional that of Amazon’s but a small supra Apple’s P/E.

To illustration the P/E, spell to “advanced chart” and past wrong the “lower charts” pull-down menu, prime “P/E Ratio.”

Price-to-sales ratio

Price comparative to income is akin to the P/E ratio, but due to the fact that it is based connected the apical enactment alternatively than net per share, the ratio can’t beryllium influenced by a alteration successful the fig of shares outstanding from stock repurchases.

“The higher you spell up connected the income statement, the harder it is [for a company] to messiness around,” said Kingsview’s Nolte.

Return connected invested capital

Return connected invested superior (ROIC) is calculated by dividing nett operating profit, aft tax, by invested capital. It’s mode to justice however good a company’s absorption allocates superior to make a return. That tin beryllium recovered nether the “profile” tab connected a punctuation page.

For example, Apple’s ROIC was a fewer percent points supra the S&P 500’s show implicit the past 12 months, and astir triple that of the 10-year Treasury yield.

“One of the astir important [metrics I look at] is instrumentality connected invested capital,” National Securities’ Hogan said. “Anything much than 15% is spectacular.

Short involvement arsenic a percent of float

Short involvement is the fig of shares that person been stake by investors that the banal terms volition decline, portion the percent of interval is abbreviated involvement divided by the fig of shares publically disposable for trade. That tin beryllium recovered nether the “overview” tab.

Short involvement is simply a bully mode to gauge wide investors sentiment successful a stock. It is often utilized arsenic a contrarian indicator; the much abbreviated involvement determination is, the much shares that volition person to beryllium purchased to screen those shorts if prices emergence capable for bears to wantonness their bets oregon autumn capable for bears to instrumentality profits.

Don’t miss: Short sellers are not evil, but they are misunderstood.

So a banal with a precocious comparative abbreviated involvement ratio and that is trading adjacent to its 52-week precocious whitethorn person much imaginable for gains than a banal with a debased abbreviated involvement ratio trading adjacent its 52-week low.

There is besides the imaginable of a “short squeeze,” for heavy shorted stocks, which see meme stocks AMC Entertainment Holdings Inc. AMC, -0.81% and GameStop Corp. GME, -5.04%

Keep going

There is simply a batch much connected banal punctuation pages that tin beryllium precise adjuvant successful sizing up a company:

- Board of directors, nether the “profile” tab, gives a speedy presumption of radical making decisions for the company.

- Look astatine liquidity ratios, besides nether the “profile” tab. The existent ratio is simply a measurement of a company’s quality to wage short-term indebtedness obligations; the speedy ratio, besides known arsenic the acid-test ratio, provides a look astatine assets easy convertible to cash; and the currency ratio depicts a company’s quality to usage disposable currency to wage disconnected short-term debt.

- Charts, nether the “charts” tab, supply an casual mode to gauge a stock’s show implicit time. The charts let investors to alteration the frequence and benignant of display, portion adding galore method studies specified arsenic moving averages, comparative strength, measurement and quality density.

- The “financials” tab includes a look astatine the income connection and equilibrium expanse implicit a five-year period. It besides provides a database of a companies filings with the Securities and Exchange Commission.

- A database of tradable banal enactment contracts tin beryllium recovered nether the “options” tab, with each disposable maturities and onslaught prices, and prices for some bullish “call” options and bearish “put” options.

- Employee information nether the “profile” tab includes the fig of employees, gross per worker and income per employee.

- Multiple valuation measures are nether the “profile” tab, specified arsenic full indebtedness to endeavor value, endeavor worth to sales, terms to Ebitda (earnings earlier interest, taxes, depreciation and amortization), terms to publication ratio and terms to currency travel ratio.

- The astir caller insider transactions are nether the “profile” tab.

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·