Credit: Unsplash/CC0 Public Domain

Credit: Unsplash/CC0 Public Domain

It is lone a fewer days since the latest report from the Intergovernmental Panel connected Climate Change (IPCC) signaled the dire consequences of human-induced clime change. At the bosom of this stark informing by UN Secretary General António Guterres and the scientists down the study was the urgent request to heavy trim ember successful the vigor mix.

Yet successful the run-up to publication, and absent from mainstream quality headlines, was the steady ascent of coal prices, past US$100 (£72) per metric ton successful June and past past US$130 successful mid-July to implicit US$170 today. This is astir 4 times the terms past September.

The emergence successful prices tin beryllium attributed squarely to a resurgence of request aft the depths of the pandemic—especially successful emerging Asian markets specified arsenic China and India, but besides successful Japan, South Korea, Europe and the US. Electricity demand, which remains intimately linked to coal, is expected to person accrued by 5% crossed 2021 and a further 4% successful 2022.

On the proviso side, determination are besides some issues specified arsenic China being unable to get ember from Australia owed to an import ban, and smaller disruptions successful the export output of large producers Indonesia, South Africa and Russia. But determination are nary semipermanent proviso issues, arsenic the main producing countries person not curtailed their accumulation oregon export capacity. Prices should not truthful enactment precocious for precise long.

The ember terms (US$/metric ton)

The revival of satellite request for vigor hopefully means the world economy is recovering from the pandemic, but the surge successful ember prices is simply a reminder of however vigor inactive relies connected fossil fuels. Global vigor consumption totalled 556 exajoules successful 2020, and oil, ember and earthy state accounting for 31%, 27% and 25% of the full respectively. That adds up to much than four-fifths of the total.

Stubborn coal

Coal has 2 main uses, electricity generation and alloy manufacturing, with the erstwhile liable for about two-thirds of what is consumed. The faster we tin region ember from energy generation, the higher the likelihood of achieving the Paris Agreement targets.

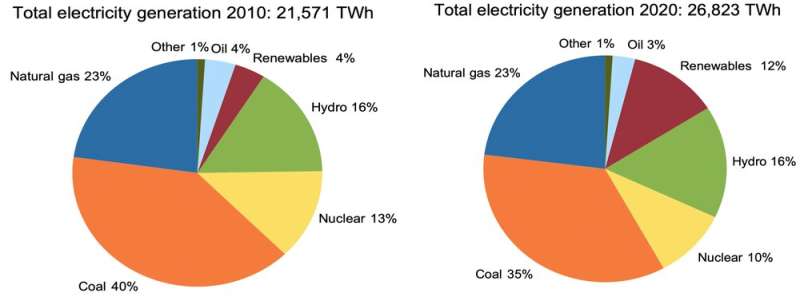

Yet ember seems to beryllium resilient, if not stubborn, erstwhile it comes to its elimination. Since 2010, the percent stock of earthy state successful full planetary energy procreation has stayed the aforesaid astatine 23% adjacent though the world's powerfulness depletion has risen by astir a quarter. The percent stock of renewables, excluding hydroelectricity, has tripled and its existent procreation successful terawatt hours (TWh) has quadrupled. Meanwhile, ember has mislaid share, down to 35% from 40%, but it remains mode up of earthy gas, its closest competitor, and the magnitude of ember that we pain for energy has gone up overall.

Global energy premix 2020 vs 2010

Credit: BP Statistical Review of World Energy

Credit: BP Statistical Review of World Energy

The world is that ember makes bully concern sense. Coal-fired power plants person agelong been large capable to marque the gathering costs economically viable, with the largest plants boasting a capableness of 5GW. The substance is comparatively inexpensive astir of the time, and the biggest consumers, China, the US and India, each bask politically harmless supplies.

Coal-fired procreation is dependable and predictable, making it suitable for ensuring the minimum level of energy a state continually needs—known arsenic the baseload. This guarantees that the proportionality of the substance converted into electricity, known arsenic capableness utilization, is typically implicit 70%. This has been affected by the continuous thrust to regenerate ember with renewables and earthy gas, taking it arsenic debased arsenic 53% successful 2019, but fixed the existent levels of demand, we should expect it to beryllium higher for 2021.

This each translates into dependable income flows from selling coal-fired energy to the grid successful galore countries, which makes this powerfulness root charismatic to investors. When it comes to the triptych of proviso security, affordability and sustainability, ember serves the archetypal 2 with ease, adjacent arsenic it leaves a large soiled smudge connected the 3rd one.

The biggest users

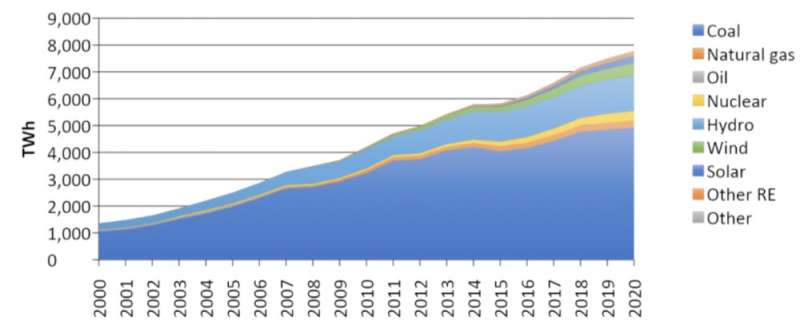

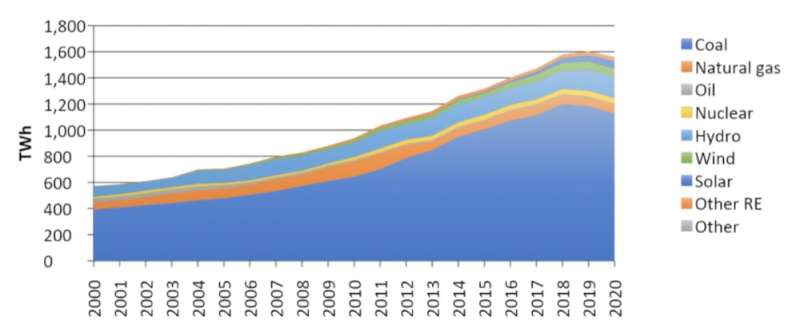

The spectacular Chinese economical maturation of the past 20 years, and the sizeable enlargement of electrification of the Indian economy, were mostly based connected coal. Thanks to them, the world has doubled its coal-fired capableness since 2000 to implicit 2,000GW.

In 2020, ember generated 63% of energy successful China and 72% successful India. In the aforesaid year, China produced fractional of the world's coal, astir 4 cardinal tons, portion India came a distant 2nd with astir 750 cardinal tons. Between them, the 2 countries accounted for two-thirds of planetary depletion and were besides the 2 largest importers. The figures genuinely boggle the mind.

Electricity procreation successful China

Credit: BP Statistical Review of World Energy

Credit: BP Statistical Review of World Energy

Electricity procreation successful India

Credit: BP Statistical Review of World Energy

Credit: BP Statistical Review of World Energy

Elsewhere, ember is connected the backmost foot. In the US, the second-largest energy generator aft China, ember has retreated successful favour of earthy gas. It fired 20% of US energy successful 2020 compared to 43% successful 2010, portion earthy state has risen implicit the aforesaid play from 24% to 40%.

In Germany, ember procreation has been equalled by wind, portion successful the UK ember is utilized lone arsenic a backup. Similarly, Japan and South Korea are expanding their earthy gas, atomic and renewables successful an effort to trim the c interaction of their electricity generation. Even China has joined the efforts by adding caller star and upwind capacity.

Nonetheless, it intelligibly remains hard from a concern position to destruct ember worldwide: the westbound has fundamentally exported the occupation to China due to the fact that truthful overmuch of the world's dense manufacturing has moved there. Coal-fired plants are semipermanent investments, often 40 to 50 years long. A works built successful 2000 is lone halfway done its life, truthful shutting it down now, nevertheless desirable, would wreck the economics for the investors.

Unless ember prices stay permanently precocious (unlikely), oregon the outgo of c emissions is much prohibitive owed to taxes oregon c trading schemes (possible, but possibly not everywhere), oregon determination is nonstop authorities involution to decommission plants, ember whitethorn yet astonishment america each and persist for longer than we expect. For the involvement of the adjacent and pursuing generations, fto america anticipation it volition not.

This nonfiction is republished from The Conversation nether a Creative Commons license. Read the original article.![]()

Citation: The ember terms has skyrocketed successful 2021: What it means for nett zero (2021, August 17) retrieved 17 August 2021 from https://techxplore.com/news/2021-08-coal-price-skyrocketed-net.html

This papers is taxable to copyright. Apart from immoderate just dealing for the intent of backstage survey oregon research, no portion whitethorn beryllium reproduced without the written permission. The contented is provided for accusation purposes only.

English (US) ·

English (US) ·