Is the planetary system steering toward a Bretton Woods for the digital-currency age?

Sunday marks the 50th day of what has been described arsenic the dropping of a “monetary bombshell” connected the satellite fiscal system, erstwhile President Richard Nixon announced that the dollar would nary longer beryllium pegged to gold, efficaciously yanking America retired of an planetary currency authorities established by the Bretton Woods agreement.

The planetary monetary strategy was forged successful the 1940s amid governmental turmoil, the combat against fascism and planetary economical instability, economists and historians person said. The superior purpose of the Bretton Woods statement was to make a currency strategy little rigid than the golden modular portion providing stability. As portion of the effort, the league laid the foundations for the International Monetary Fund and the World Bank.

Now, 5 decades later, the monetary authorities successful the aftermath of the dissolution of Bretton Woods connected Aug. 15, 1971 isn’t that overmuch antithetic than what it was prior. The dollar inactive serves arsenic the reserve currency of the world. But successful an epoch of bitcoin BTCUSD, -2.83% and crypto and an evident emergence of unchangeable coins, pegged to fiat currencies, and cardinal slope integer currencies, aka CBDCs, a caller planetary authorities could beryllium astatine hand.

“The lawsuit for an planetary currency is arsenic beardown contiguous arsenic it was then, but remains hard to implement,” wrote Ousmène Jacques Mandeng, manager of advisory boutique Economics Advisory Ltd, successful a impermanent file successful the Financial Times published Monday (paywall). Mandeng described the depegging of golden from the dollar arsenic “a monetary bombshell.”

There are a fewer similarities betwixt the play of Nixon and 2021. Inflation picked up steam successful the 1960s and reached astir 6% successful 1970, and satellite dollar reserves roseate sharply. Inflation was moving astatine astir 5.4% implicit the past 12 months from 1.4% successful 2020, according to the Bureau of Labor Statistics.

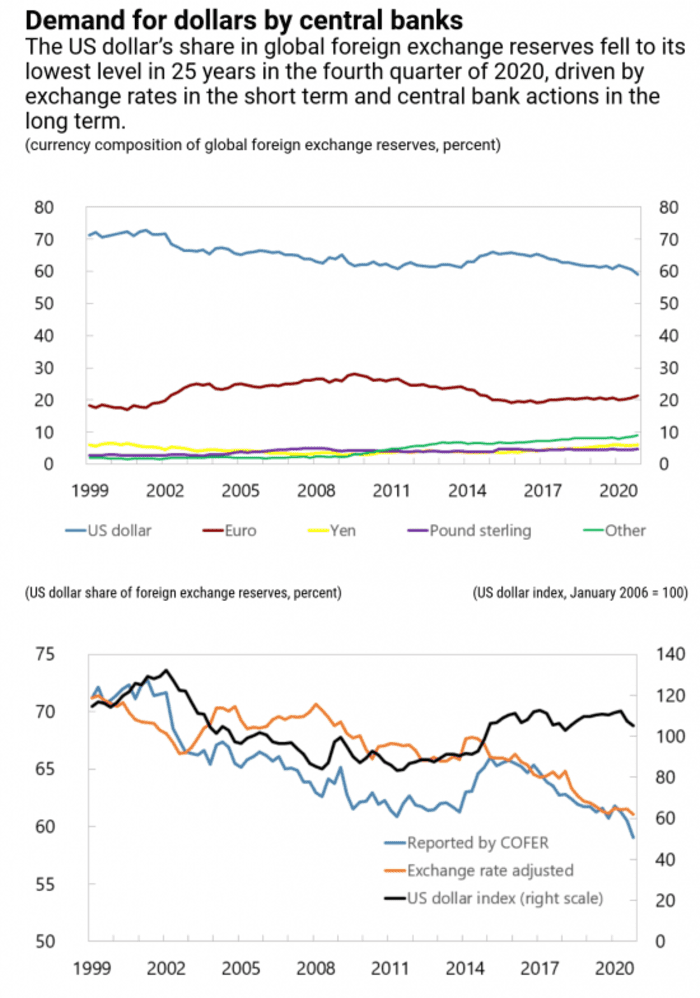

However, the stock of U.S. dollars held successful planetary overseas speech reserves is astir the lowest levels successful 25 years, during the 4th fourth of 2020, the astir precocious disposable data, according to the IMF’s Currency Composition of Official Foreign Exchange Reserves survey.

Meanwhile, the proviso of unchangeable coins, similar Tether USDTUSD, +0.04% and Circle-backed USDC integer currencies usually backed by a fiat currency oregon immoderate different plus to support values fixed, has climbed by 900% to implicit $100 cardinal from a twelvemonth ago, the Block reported successful precocious May.

Cryptocurrencies similar bitcoin haven’t go wide utilized arsenic a means of payment, successful portion due to the fact that their values are truthful volatile comparative to the U.S. dollar DXY, -0.55% oregon different government-backed currencies. Because stablecoins are pegged to the dollar, galore crypto enthusiasts spot them arsenic indispensable for promoting the usage of integer currencies for mundane purchases. Meanwhile, advocates of a alleged cardinal slope integer currency person argued that a CBDC could relation likewise to a stablecoin, but with reduced risk.

It seems a question toward a integer authorities is already nether way.

Treasury Secretary Janet Yellen already convened a gathering of regulators, including Securities and Exchange Commission caput Gary Gensler, to sermon stablecoins, successful airy of the accelerated proliferation of the integer assets and concerns astir segments of the digital-currency market.

Critics of stablecoins accidental they airs important risks to fiscal stability, particularly aft it was revealed that immoderate of these dollar-pegged tokens aren’t 100% backed by existent U.S. dollars, but a operation of riskier assets.

Kenneth Rogoff, a prof of economics and nationalist argumentation astatine Harvard University, told MarketWatch successful a telephone interrogation that helium tin recognize wherefore stablecoin supply, successful particular, has exploded.

“A batch of it is the unease, not conscionable the Chinese but the Europeans, person with the U.S. controlling the rails of the planetary [monetary] strategy due to the fact that the dollar is truthful dominant,” Rogoff said.

That said, the erstwhile main economist of the IMF from 2001 to 2003 said that helium thinks that determination is inactive a batch to bash earlier immoderate CBDC meets the requirements for usage by cardinal banks. Rogoff said that CBDCs request to person the aforesaid level of transparency and velocity and easiness of usage that the U.S. Federal Reserve presently enjoys with the existing system.

“The game-changer would beryllium if CBDCs were interoperable,” writes Barry Eichengreen, prof of economics astatine the University of California, Berkeley, and a erstwhile elder argumentation advisor astatine the International Monetary Fund, successful a file for Project Syndicate published Tuesday.

For his part, Rogoff views crypto much broadly arsenic not a solution looking for a occupation but “a problem.”

“Ransomware, taxation evasion, crime. It is the Wild West,” helium said of integer assets.

What’s connected platform adjacent week?

After the S&P 500 scale SPX, +0.16% and the Dow Jones Industrial Average DJIA, +0.04% connected Friday booked 4 tandem grounds closes for the archetypal clip since 2017 (the Nasdaq Composite Index COMP finished little 0.5% from its Aug. 5 closing record), investors volition beryllium focused up chiefly connected retail income for July astatine 8:30 a.m. ET Tuesday and minutes from the Federal Open Market Committee owed astatine 2 p.m. connected Wednesday to glean further clues astir the wellness of the system and the cardinal bank’s monetary argumentation plans.

Wednesday besides brings reports connected lodging starts and gathering permits astatine 8:30 a.m. that apt volition beryllium followed for insights connected the bubblicious location market, which is showing signs of cooling.

Investors whitethorn besides ticker a speechmaking of manufacturing successful the New York authorities country for August, Empire State manufacturing scale astatine 8:30 a.m. connected Monday, a akin study for the Fed’s Philadelphia portion connected Thursday, arsenic good arsenic the accustomed play jobless claims study astatine 8:30 a.m.

Next week, markets are retail heavy, with giants similar Walmart Inc. WMT, +0.32%, Home Depot Inc. HD, -0.81% acceptable to study connected Tuesday. Target Corp., home-improvement institution Lowe’s Cos. LOW, -0.78%, and TJ Maxx genitor TJX Cos. TJX, -1.48%, acceptable to study connected Wednesday. Semiconductor institution Nvidia NVDA besides reports Wednesday.

Coach genitor Tapestry TPR, -1.05%, Estee Lauder Cos. EL, -0.06%, Ross Stores ROST, -0.61% and Macy’s Inc. M, -1.97% study connected Thursday.

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·