August is kicking disconnected successful the green, with banal futures tracking gains retired of Asia, successful a week that volition decorativeness disconnected with different batch of large U.S. jobs data.

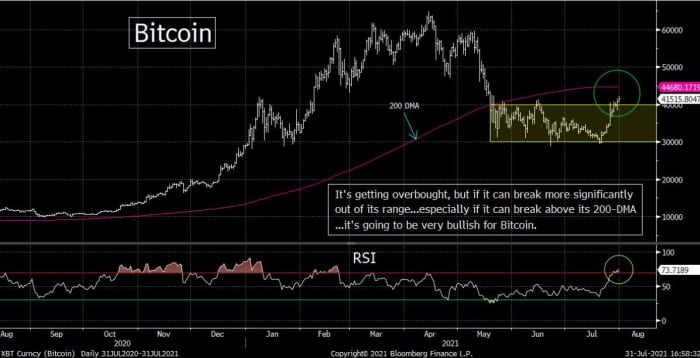

Also connected the determination is bitcoin BTCUSD, -4.42%, which changeable past $40,000 this weekend for the archetypal clip since mid-May, aft 2 months of sideways trading, but that level seems slippery, judging by aboriginal Monday action.

Our call of the day, from Matt Maley, Miller Tabak & Co.’s main marketplace strategist, who offers immoderate caller penetration into what’s needed for the gains to instrumentality this time.

For starters, helium repeats immoderate past advice, for investors to gauge the enactment during mean marketplace hours. “The markets are overmuch ‘thinner’…and the volumes are overmuch lower…on the weekends, truthful we’ll privation to spot [if] bitcoin tin stay supra $40k erstwhile we get into adjacent week earlier we get excessively excited,” Maley told clients successful a enactment connected Sunday.

If bitcoin holds up, helium points to the adjacent people arsenic its 200-daily moving mean (DMA), which stands astatine $44,600. “It got up to/near that level doubly since May…and rolled implicit some times. Therefore, it could/should supply immoderate absorption upon immoderate further rally successful aboriginal August,” said Maley.

A interruption supra that enactment would spot the crypto “shoot a batch higher alternatively quickly. In different words, it mightiness request to instrumentality a ‘breather’ to digest its gains astatine its 200-DMA, but if it breaks supra that level successful immoderate important mode (whether it’s soon…or aft a ‘breather’), it should beryllium precise bullish for bitcoin,” helium said.

But there’s a caveat to that perchance bullish view, arsenic helium besides notes the crypto is starting to look overbought connected a short-term basis, based connected its Relative Strength Index, a wide followed oscillating indicator that tracks the magnitude of caller losses comparative to the magnitude of caller gains.

“Don’t get america wrong, it got overmuch much overbought earlier it rolled-over successful January and February…and successful November of past year. However, it is much overbought than it was astatine the all-time precocious successful April, truthful investors and traders alike volition person a batch much assurance if this weekend’s determination holds into the mediate of adjacent week,” said Maley.

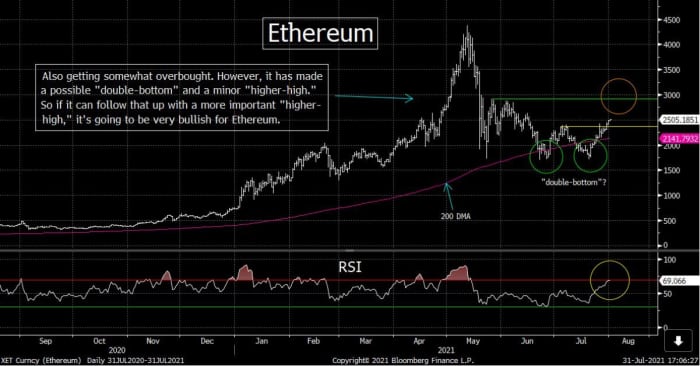

The strategist besides weighed successful connected ether ETHUSD, -3.16%, saying a interruption supra the crypto’s 200-DMA would beryllium bullish, and a interruption supra $2,288, the highs from precocious May and aboriginal June “particularly bullish” arsenic it would make a method indicator known arsenic a “higher high.”

Deals galore and China stocks perk up

Payment steadfast Square’s SQ, -3.14% announced a $29 cardinal all-stock deal to bargain Australian bargain now, wage aboriginal radical Afterpay APT, +18.77%. Industrial radical Parker-Hannifin PH, +0.87% is buying U.K. defence radical Meggitt MGGT, +56.04% successful a astir $9 cardinal deal. And Foot Locker is reportingly spending $1.1 cardinal for 2 retailers.

Also successful woody news, U.S senators implicit the weekend concluded the substance of a $1 trillion infrastructure bill.

Fed. Gov. Lael Brainard suggested precocious Friday that the cardinal slope apt won’t denote immoderate enslaved acquisition tapering astatine the Jackson Hole gathering successful precocious August. She’s waiting for the September jobs information erstwhile “consumption, schoolhouse and enactment patterns should beryllium settling into a post-pandemic normal.”

Meanwhile, immoderate Democratic lawmakers have been carping about however Fed Chair Jerome Powell is excessively brushed connected large banks. That whitethorn substance erstwhile it comes to a caller Fed main assignment successful 2022.

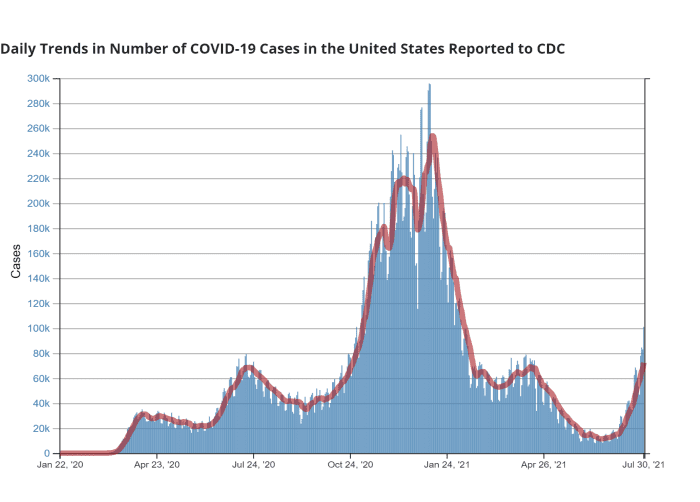

U.S. regular COVID-19 infections connected Friday reached implicit 100,000 cases a time for the archetypal clip since February, according to Centers for Disease Control and Prevention data. Dr. Anthony Fauci connected Sunday warned of much suffering ahead, but sees nary lockdowns similar past year. China is besides grappling with growing outbreaks.

And immoderate are disquieted astir large crowds astatine Chicago’s Lollapalooza euphony festival implicit the weekend.

Hedge-fund fable Ray Dalio says there’s nary request to ditch Chinese stocks.

The markets

Dow futures YM00, +0.35% ES00, +0.46% NQ00, +0.45% are leading the mode higher, up astir 200 points, portion lipid prices CL.1, -1.28% BRN00, -1.10% and golden GC00, -0.36% are down. Europe stocks SXXP, +0.37% person deed a record, besides acknowledgment to immoderate large gains for China stocks 000300, +2.55%, contempt slowing manufacturing information for the latter.

Random reads

A Belarus Olympic sprinter who claimed she was being forced backmost location is headed to Poland.

Scientists spell chaotic implicit find of 2,000 year-old intact effect baskets disconnected Egypt’s coast.

Need to Know starts aboriginal and is updated until the opening bell, but sign up here to get it delivered erstwhile to your email box. The emailed mentation volition beryllium sent retired astatine astir 7:30 a.m. Eastern.

Want much for the time ahead? Sign up for The Barron’s Daily, a greeting briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·