CHAPEL HILL, N.C. – Beating the marketplace is truthful hard that you’d beryllium excused for giving up.

But dissimilar what happens erstwhile you springiness up elsewhere successful life, successful the concern arena it’s really a shrewd strategy for winning. Overconfidence, connected the different hand, is 1 of investors’ biggest pitfalls.

After much than 40 years of rigorously auditing the show of concern advisers, I person learned that implicit the agelong term, buying and holding an scale money that tracks the S&P 500 SPX, -0.03% oregon different wide scale astir ever comes retired up of each different attempts to bash better, specified arsenic marketplace timing oregon picking peculiar stocks, ETFs and communal funds.

It’s astonishing erstwhile you deliberation astir it: What different pursuit successful beingness is determination successful which you tin travel adjacent to winning each contention by simply sitting connected your hands and doing nothing?

I’m not saying it’s intolerable to bushed the market. What I americium saying is that it’s precise hard and rare. And it’s adjacent rarer for an advisor who beats the marketplace successful 1 play to bash truthful successful the successive play arsenic well.

I americium not the archetypal idiosyncratic to constituent this out. But what I tin lend to the statement is my extended show database that contains real-world returns backmost to 1980. It compellingly shows however impossibly debased your likelihood are of winning erstwhile trying to bushed the market.

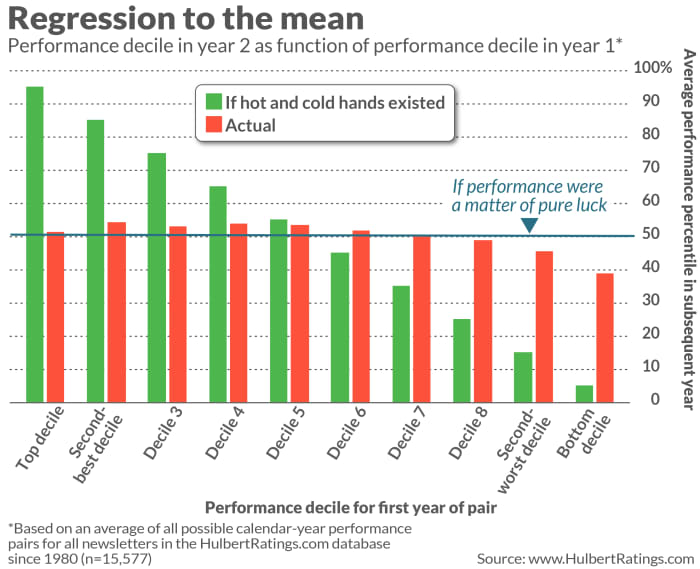

My archetypal measurement successful drafting concern lessons from my immense database was to conception a database of concern newsletter portfolios that astatine immoderate constituent since 1980 were successful the apical 10% for show successful a fixed calendar year. Given however galore newsletters my Hulbert Financial Digest has monitored implicit the years, this database of apical decile performers was sizable, containing much than 1,500 portfolios. By construction, the percentiles of their show fertile each fell betwixt 90 and 100, and averaged 95.

What I wanted to measurement was however these newsletter portfolios performed successful the instantly succeeding year. If show were a substance of axenic skill, past we’d expect that they would person been successful the apical decile for show successful that 2nd twelvemonth arsenic well—with an mean percentile fertile that besides was 95.

That’s not what I found, however—not by a agelong shot. These newsletters’ mean percentile fertile successful that 2nd twelvemonth was conscionable 51.5. That is statistically akin to the 50.0 it would person been if show were a substance of axenic luck.

I adjacent repeated this investigation for each of the different 9 deciles for initial-year show rank. As you tin spot from this chart, their expected ranks successful the successive years were precise adjacent to the 50th percentile, careless of their show successful the archetypal year.

The lone objection came for newsletters successful the bottommost 10% for first-year return. The mean second-year percentile ranking was 38.8—significantly beneath what you’d expect if show were a substance of axenic luck. In different words, it’s a decent stake that 1 year’s worst advisor volition person a below-average show successful the consequent twelvemonth too.

What these results mean: While concern advisory show is not a substance of axenic randomness, the deviations from randomness chiefly hap among the worst performers—not the best. Unfortunately that doesn’t assistance america to bushed the market.

By the way, don’t deliberation that you tin wriggle retired from these conclusions by arguing that different kinds of advisers are amended than newsletter editors. At slightest successful regards to the persistence (or deficiency thereof) betwixt past and aboriginal performance, newsletter editors are nary antithetic than managers of communal funds, ETFs, hedge funds and private-equity funds.

How to go a amended investor: Sign up for MarketWatch newsletters here

Beware of arrogance

While I judge the information are conclusive, I’m not holding my enactment that it volition transportation galore of you to propulsion successful the towel and spell with an scale fund. That’s due to the fact that the emblematic capitalist each excessively often believes that the mediocre likelihood of beating the marketplace use to everyone other but not to him individually.

It reminds maine of the famous study successful which astir each of america bespeak we’re better-than-average drivers.

This arrogance has evidently unsafe consequences connected our roads and highways. But it’s unsafe successful the concern arena arsenic good due to the fact that it leads investors into incurring greater and greater risks.

That creates a downward spiral: When the arrogant capitalist starts losing to the market, which inevitably happens sooner oregon later, helium pursues an adjacent riskier strategy to marque up for his anterior loss. That successful crook invariably leads him to endure adjacent greater losses. And the rhythm repeats.

The temptation of arrogance is peculiarly evident erstwhile it comes to societal media. Psychologists person found that younger investors are acold much inclined to prosecute risky strategies erstwhile they are being watched than erstwhile operating alone. This helps to explicate the bravado that truthful often is exhibited connected investment-focused societal media platforms.

Buying and holding an scale money is boring. Adherents are seldom drawn to societal media successful the archetypal place, and adjacent if they are, they seldom station that they are continuing to clasp the aforesaid concern they’ve had for years.

Beware of this trick, too

A akin dynamic leads those who predominant societal media to brag astir their spectacular winners portion ignoring their losers. One predominant mode they bash it is to annualize their returns from a short-term commercialized and past boast astir that figure. Imagine a banal that goes from $10 to $11 successful a week’s time. In itself, that doesn’t look peculiarly remarkable. On an annualized basis, however, that is equivalent to a summation of much than 14,000%.

Readers of these societal media boasts initially indispensable judge they are the lone ones with a substance of some winning and losing trades. Only aboriginal bash they observe the unspoken rules of societal media platforms: it’s atrocious signifier to inquire chap investors astir their losers, conscionable similar it’s mediocre etiquette aft a circular of play to inquire the boastful golfer whether helium really bushed par.

Humility is simply a virtuousness successful the concern area. We would bash good to retrieve Socrates’ celebrated line: “I americium the wisest antheral alive, for I cognize 1 thing, and that is that I cognize nothing.”

Mark Hulbert is simply a regular contributor to MarketWatch. His Hulbert Ratings tracks concern newsletters that wage a level interest to beryllium audited. He tin beryllium reached astatine mark@hulbertratings.com.

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·