Post Labor Day sees investors returning to the S&P 500 SPX, -0.03% adjacent all-time highs and immoderate acheronian economical shadows lurking. Chiefly successful the interest country is Friday’s anemic jobs data, which comes against backdrop of higher prices, starring to whispers of dreaded stagflation.

Supply concatenation problems being created by the coronavirus and its variants does rise that stagflation possibility, Matt Maley, main marketplace strategist astatine Miller Tabak + Co, told clients successful a play note. “If/when it does, some the banal marketplace and the enslaved marketplace are going to respond successful a precise antagonistic mode (and astir apt precise quickly),” helium cautions.

Maley has different informing for investors successful our call of the day, arsenic helium ticks disconnected a database of “strong similarities” betwixt stocks present and the heady markets of 1999, 2007 and 1929. He’s not saying we’re going to spot a carnivore marketplace specified arsenic what transpired astir those years, but thinks an “inevitable heavy correction,” is much apt than astir of Wall Street expects.

Here’s that database of similarities:

- The S&P 500 is trading astatine a lofty 22.5 times guardant net and its price-to-sales ratio of 3.1 times is acold costlier than successful 2000. The Nasdaq-100 tracking QQQ exchange-traded money QQQ, +0.31% is trading astatine a 70% premium to its 200-week moving average, the biggest since 1999/2000.

- “Blank-check” oregon special-purpose acquisition companies wherever investors person nary thought what the concern volition be. “The past clip SPACs were arsenic large arsenic they are today? That’s close 1928/1929,” said the strategist.

- Leverage highs. Similar to 1920 and 2000, borderline indebtedness has changeable to caller highs, which is good until it starts heading the different way. It has precocious started to unwind and if that keeps going, markets person a problem.

4. Cryptocurrencies. Maley said he’s bullish longer-term connected cryptos, but is acrophobic astir “froth,” fixed a 1,000% summation for bitcoin since the Federal Reserve’s monolithic quantitative easing programme began successful 2020, with Ethereum up 3,400%.

5. Individual investors marque up 20% of mean regular measurement for stocks, doubly the level of 2 years ago. Many large marketplace tops of the past — 1929, 1999/2000 — were marked by large jumps successful capitalist activity.

6. From 1998 to 2000, tons of companies with zero net saw shares sprout higher and investors heap in, and Maley sees parallels with `so-called “meme” stocks of today.

Maley said he’s not predicting a pullback akin to those large years, and timing of immoderate pullback is evident tough. “However, it is our sentiment that the hazard broadside of the risk/reward equation has grown substantially implicit the past respective months…and therefore, we judge that investors should rise a small currency astatine these levels,” helium said.

“If/when this ‘everything rally’ ends, astir everything volition decline. Therefore, (at least) immoderate currency volition beryllium 1 of the fewer hedges that investors volition find palmy if/when the marketplace corrects,” said Maley.

Soros warns connected China and Match headed to the S&P 500

Barclays strategists lifted their S&P 500 terms people to 4,600 from 4,400, arsenic they don’t spot immoderate Federal Reserve tapering triggering a “significant marketplace selloff.”

Storied capitalist George Soros blasted BlackRock BLK, -0.98% for recommending its investors triple their vulnerability to China, successful a Wall Street Journal op-ed. China stocks 000300, +1.20%, incidentally, got a assistance Tuesday from strong commercialized data.

Columbia Property Trust shares CXP, -1.14% are soaring aft the existent property concern trust announced a $3.9 cardinal deal to beryllium acquired by funds managed by Pacific Investment Management (PIMCO).

Deutsche Telekom DTE, +0.30% volition assistance its involvement successful T-Mobile US TMUS, -0.10% will increase arsenic portion of a strategical concern and equity stock swap with SoftBank Group 9984, +9.86%.

Shares of Match.com MTCH, +0.73% are surging connected quality the dating-app institution will beryllium added to the S&P 500, replacing WW International WW, +2.30%, which is headed to the S&P SmallCap 600 SML, -0.60%.

Goldman Sachs GS, -0.77% volition list its alternate assets absorption portion Petershill Partners connected the London Stock Exchange.

Facing fierce societal media backlash, videogame developer Tripwire Interactive has replaced its CEO who voiced enactment for a Texas termination instrumentality successful a tweet Sunday.

The markets

Stocks look set to clasp adjacent grounds highs, judging by futures ES00, +0.06% YM00, +0.10% NQ00, -0.01% action. Europe stocks are giving up immoderate gains arsenic investors look up to Thursday’s European Central Bank meeting. The Reserve Bank of Australia tapered its ain enslaved buying astatine Tuesday’s meeting.

The chart

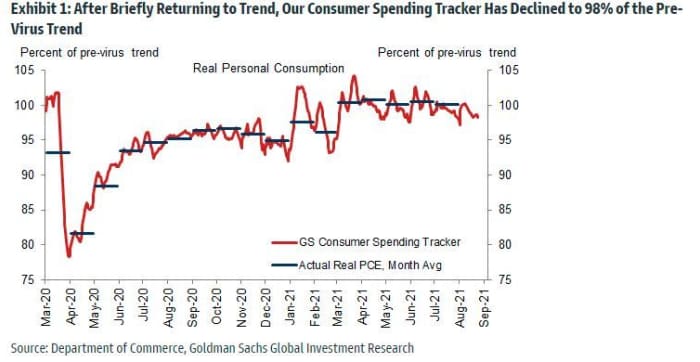

Goldman Sachs is disquieted that the delta variant of coronavirus, fading fiscal stimulus and a slower work assemblage betterment volition measurement connected user spending implicit the adjacent fewer quarters. Their GDP presumption for 2021 has been trimmed to 5.7% from 6.2%, but to 4.6% from 4.3% for 2022.

Random reads

Tributes determination successful for the late Michael K. Williams of “The Wire” and “Boardwalk Empire” fame.

“You bloody fool,” said the duck raised successful captivity.

Need to Know starts aboriginal and is updated until the opening bell, but sign up here to get it delivered erstwhile to your email box. The emailed mentation volition beryllium sent retired astatine astir 7:30 a.m. Eastern.

Want much for the time ahead? Sign up for The Barron’s Daily, a greeting briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·